One of my 2014 financial resolutions was to make my money work for me. I’ve long heard the stories of folks that are vacationing free and enjoying making their money work for them two-fold and I wanted to be a part of the club! I committed to this and so far it’s been working out well.

Here are the ways I’m making my money work for me.

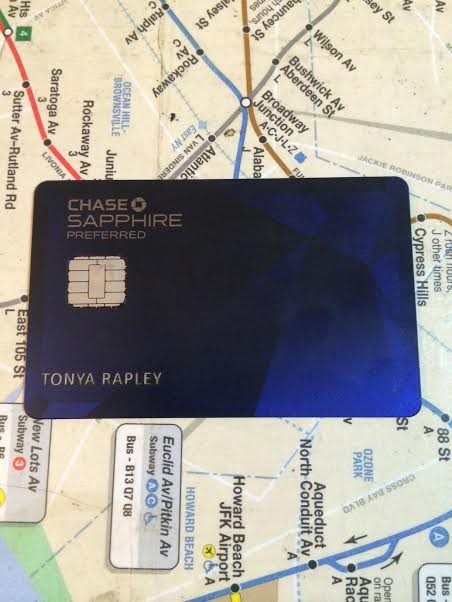

My Chase Sapphire Rewards card.

I’ve long heard about the perks of this card. I applied at the top of the year and ever since I have considered it to be the cornerstone of my “Money Well Spent” plan.

It requires a relatively high minimum spend at $3,500 but you earn 40,000 miles for that.

You earn double miles on food and travel so I earn double miles when I ride in a taxi, when I order food from any place that serves food, buy groceries, plane tickets, AirBnB, and more! What I love most about this card is that you can transfer your miles easily.

About 1 month ago I was headed to DC and didn’t feel like taking the bus after work. I was able to transfer 4,000 miles over instantly to cover the cost of my Amtrak ticket. I can also transfer money to airline carriers such as Virgin and British Airways or hotel partners. I’ve decided to save my miles for a trip to the Philippines next year and plan to use them to cover at least my flight.

Some cards also boast cash back. I do not have one but I hear great things about them. I’m personally not interested in a card if it doesn’t provide me with travel points.

Friends have been telling me about E-Bates for a while but I’ve been a late adapter. However, recently I signed up and became hooked. When purchasing off E-bates keep in mind that some purchases make sense while others don’t. For instance I earned 8% cash back for the Mother’s Day gift I purchased my mom. That made sense because I was going to have to pay shipping and handling anyway. But I considered ordering my pet food from E-bates but after shipping and handling I would have been spending more than what I would have gotten back. The goal here is to spend smart.

So far I’ve earned $10 back but I plan to channel every purchase within reason through E-bates. I will keep you all posted on my earnings.

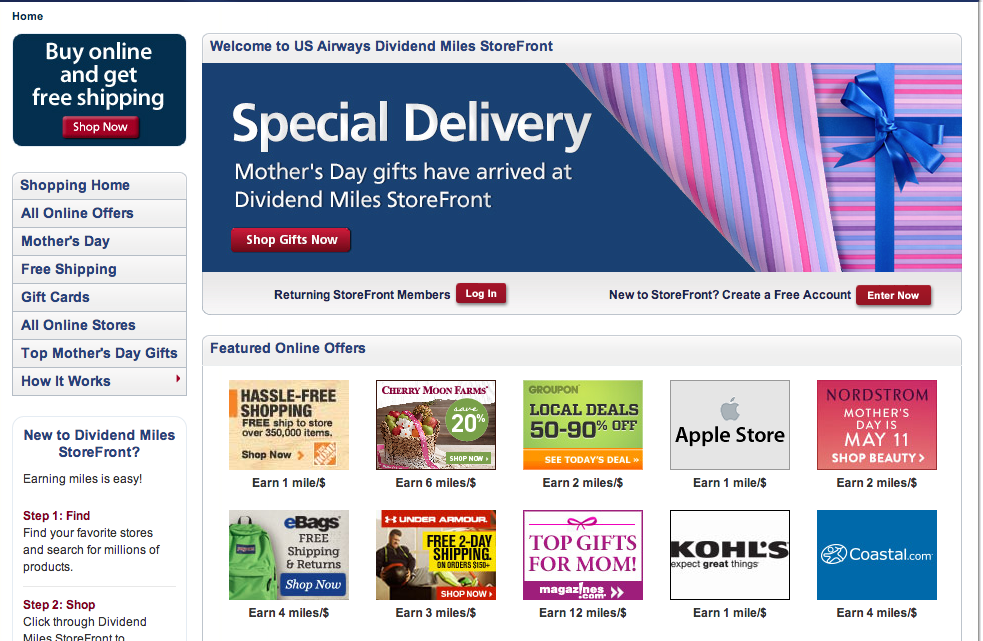

Online shopping malls to maximize miles.

So you’re not keen on using credit cards to earn miles. Understandable.

Did you know that many mile programs have online shopping miles? You won’t rack up miles as quickly as you would with a credit card but you’re earning something for your money. I’ve long used US Airways Dividend Miles and continue to. I go through their storefront when making many online purchases unless they have ridiculous shipping fees. Most stores have a free shipping offer after a certain amount is spent. I recently earned 400 miles by ordering my Sephora product online rather than in store.

Note to you. ALWAYS sign up for mileage/ loyalty programs when the opportunity presents itself. I use AwardWallet to keep all of my programs in order.

This is just the tip of the iceberg. There are so many others making their money work for them and I anticipate implementing a few more strategies by the end of the year.

How are you doing it?

*This post contains affiliate links which means that I will also earn money if you click on them. I will never promote any affiliate that is not good for My FabFinance readers and our goal of financial fabulousness.

You said: