Everything happens for a reason. This weekend I was gifted with a ticket to Doreen Rainey’s absolutely amazing Get Radical Conference by my sis-STAR Kara Stevens. I headed to D.C for a conference that was promoted to a game-changer.

I was not prepared for how much this weekend would change me. I was excited to the conference but admittedly not familiar with Doreen’s excellence and ability to help you unpack your “baggage” and get to the business of bettering you.

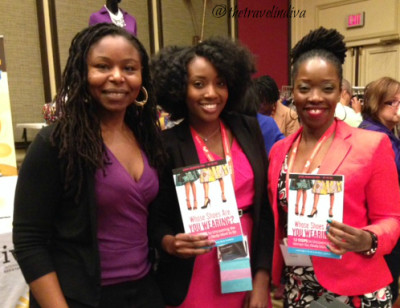

I could rave on and on an on about this conference. About the absolutely amazing women I met. Oh the women. They were so beautiful, so bold, so courageous, so different so radical. I walked away with another speaking engagement that I am very excited about. I also decided to take the leap and enlist a coach, the dynamic Cheryl Wood, to help me with my professional goals.

But I want to share with you 5 take always from this event as they pertain to your finances

Here are 5 ways to radically change your financial life:

1. If you want to win, you have to PREPARE to win. Champions prepare to win. @DoreenRianey

Do you want go to be the champion of your finances? I do and that’s why I created this blog as my accountability partner. So often we talk about what we want to do and were going to do this and that. But what are we doing to prepare ourselves?

At the conference I also had the pleasure of hearing Laila Ali speak and she spoke about her workout regimen to become the champion of women’s boxing. She was boxing men and running the hills of the Las Vegas mountains.

Are you preparing yourself to win financially whether it be asking for that raise, looking for a better paying job that also allows you to work towards you dreams. Okay you want to buy a house, but are you saving money for a down payment? Champions prepare to win, it’s not just a coincidence.

2. Identify your non-negotiables this year. What’s non negotiable for you when it comes to your finances? @DoreenRainey

Create your and then examine it. How are you doing on them? If you’ve identified them as non-negotiable meaning they absolutely have to happen, why aren’t you doing everything in your power to make them happen?

This struck a cord with me. I’m about 42 points off from accomplishing my original goal of a 750 credit score by the time I turn 30. This is non-negotiable for me but yet Im saving money for my ticket to Ghana and somewhere along the line threw a trip to Dubai in the mix. In actuality, I can use my airline miles, nix Dubai, and use that money to pay of a credit card which will improve my credit score. I really wanted to travel to Dubai y’all. I had already pictured my selfies on the dunes but! I had to change my plans because it was impacting my non-negotiable.

3. Hope is not an investment strategy. @JeanChatzsy

3. Hope is not an investment strategy. @JeanChatzsy

Let’s get real. We barely discuss investing on this site. I admit I assume it is complicated, and it can be. But I voiced this to my sis-star and it turns out she introduced me to an investment banker who doesn’t charge an up front rate, only1% of your earnings.

I know several several women who aren’t even saving for retirement. In order to win big you have to play big. I advise that you start small when it comes to investing but start somewhere. Hoping you win the lottery, or that you business takes off so that retirement will not be necessary is not a sound investment strategy.

4. Do the people around you inspire you to be your best? Do they hold you accountable. For your goals. Are they who you aspire to be?

This is a simple question yet a very different question. I know people who are married to people that don’t inspire them to be their best. Their husbands are spending frivolously or not abiding by the same financial plan as them. I know people who are hanging around people they don’t even like let alone inspire them. Challenge yourself.

While remaining true to yourself examine your circle. Are most of them miserable and complacent or are they changing their own lives? Are the talking about their dreams or are they making their dreams happen. Are they encouraging you to reach your goals and motivating you to do so? Or are they sabotaging you? Are they inviting you out to dinner knowing damn well you are broke.

Or, are you the one sabotaging the group? Are you the one acting as someone else’s ball and chain? We are only as good as the 5 people we hang around. Let’s make sure we are worth being in the inner circle as well as everyone else is worth being in our inner circle.

5. Identify your big whys. Choose 3.

Why are you working to get your finances right? Is it to buy a home? Is it to pay for your children’s college tuition?

My 3 big whys are:

I want a bi-coastal lifestyle that enables me to travel as I choose while living in a place that nourishes my soul.

I want to make a difference in the lives of others.

I want to make my parents proud. They gave up so much for my sister and I to have a stable live and a happy, healthy, enjoyable childhood. I want them to know that was not in vain.

I am so amped. This weekend helped clarify my personal goals and aspirations for My Fab Finance. I look forward to continuing to bring you great content that will help you achieve your financial goals by making lifestyle tweaks that will enable you to accomplish your whys. I can be your accountability partner!

I need something from you though.

I need your comments. While I’ve seen traffic and reader engagement grow tremendously, comments have been lul. I hope you understand I LOVE reading your comments. It informs me of what you are dealing with as well as let’s me know you were here. Doreen made the comment that if you have a blog without comments, it’s a newsletter lol that hurt my feelings a bit. This is not a newsletter and I work damn hard including writing posts at 1am and waking up at 7am to finish the posts before going to work followed by class o followed by an internship.

So I invite you to leave your mark. Come from behind that keyboard and speak out!

Are there any items on this list that resonate with you? I’d love to hear your reasons for pursuing financial independence.

You said: