This post is sponsored by H&R Block. All opinions are my own.

Believe it or not, I filed my own taxes the first time I ever filed a tax return. I was a junior in high school working as a cashier at the local grocery store. I almost missed the deadline because I assumed I wasn’t required to file taxes since I was under 18 years old.

It was the early days of online filing, so the options were limited but my return was so straight forward I was able to file with ease. Doing my own taxes gave me pride and I felt like an adult as I bragged to my friends and awaited my refund.

These days as a business owner and wife with multiple streams of income and investments, my situation isn’t as straightforward. So, I enlisted the help of a tax professional to navigate my taxes.

There are advantages to doing your own taxes. However, just as in my situation, it isn’t for everyone.

If you are still trying to determine which filing method is best for you consider the following advantage and disadvantages of doing your own taxes.

Advantages of Filing Your Own Taxes:

You can conveniently file in your own home

As long as you have a computer and reliable internet you could literally file your taxes from bed in your pajamas, provided you have all of your financial documents available.

It’s an opportunity to put your finances in perspective as you examine them

If you’re the type of person who skips routinely assessing your financial picture, tax time provides you with an opportunity to get up close and personal with your finances as you determine what came into your household and what went out over the past year.

Easy access to your necessary information

When you do your own taxes, your information is always easily accessible in your online account.

Saves money

Perhaps the most obvious of the reasons is that filing online is cost-effective and can even be free.

But with everything there are a few disadvantages.

A few advantages of filing with a tax professional:

You can avoid costly errors

The money you saved filing yourself might not be worth it. Tax professionals are professionals for a reason. They understand allowable deductions and tax laws. If you’re unfamiliar with the deductions available to you, you could end up missing out on cost saving areas. But on the opposite end, if you claim deductions that you aren’t eligible for the IRS could come back and audit you are charge you for the error log after you’ve cashed your tax refund.

You Can Save time

You know how when you start a new job, the first drive there is the longest, because you haven’t figured out the shortcuts, or the best time to leave the office to avoid traffic? There’s a learning curve to everything, your taxes included. While you could save money filing on your own, you could lose more time than it’s worth attempting to understand tax laws and how they apply to your circumstances. When working with a professional it’s highly likely they’ve encountered an individual with your scenario before so they are able to complete your taxes quicker and more efficiently than you would be able to on your own.

One reason many people don’t use a professional is because they don’t want to spend the time visiting a tax office. H&R Block launched an amazing option for these people! It’s called Tax Pro Go and it was created for folks who don’t want to go to a tax office but don’t want to do their own taxes either. With Tax Pro Go, you get professional tax prep without the office visit

Here’s how it works:

- Visit HRBlock.com/taxprogo and get started for free

- Answer a few questions about yourself such as your marital status, how many dependents you have and if you own a home

- Based on your answers, you’ll be matched with a tax pro who understands your local taxes and you will be provided with a price upfront, before you agree to do anything

- Once you agree to pricing, upload your documents

- Provide your tax professional with your contact information in the event they have questions

- Your tax professional prepares your return while you continue with your life

- Within days, your completed return and tax tips for next year are sent to you

- Review your return and pay

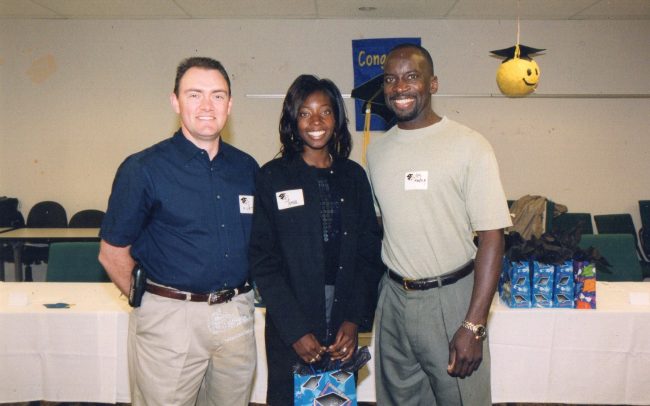

On set at the taping of the newest H&R Block Commercial for Tax Pro Go

H&R Block Tax Pro Go is the easiest way to have someone file for you.

There are many types of tax filers … from DIY to do it all for me. Visit HRBlock.com to get started with the best filing option for you today.

You said: