One of the frustrating things about improving your credit is that once collection companies see that you have turned over a new leaf and are becoming more responsible they will try to get in on the action.

Back in February I was performing one of my routine monthly credit report reviews and noticed that there was a new collection item on my report. Not only was there a new item, but my score dropped significantly.

I discovered it was an old T-Mobile debt from 2008. They said it was a service termination charge for a T-Mobile account that was open for 21-days. I asked the woman if her company offered pay for delete and she said, “No, we aren’t allowed to do that.” I reminded her that by law, they are able to do that. She continued to insist that they were unable to do it, but obviously she didn’t know who she was dealing with.

I did not recognize this debt, but I honestly would have paid the debt had they agreed to a pay for delete. Since they wanted to be difficult, I had no choice but to open up my arsenal.

I wrote them a debt collection dispute letter. By law a company has to verify a debt once a consumer requests a verification in order to continue to collect on that debt.

When dealing with debt collectors it is important to do all of your communication in writing. They often renig on agreements, sell debts you are currently paying, and practice a host of other unethical processes. While it may be convenient, do not do the online dispute. In exchange for convenience you waive your ability to re-dispute if it doesn’t come back in your favor. I will also say I have never won an electronic dispute, but I have won 75% of my written disputes. Below is an example of the letter I wrote (sans my personal information):

CERTIFIED MAIL

Enhanced Recovery System

8014 Bayberry Road

Jacksonville, FL 32256

NYC Department of Consumer Affairs License # xxxxxxx

Re: Account # xxxxxxxx

Dear Enhanced Recovery Services

On March 1,2014 I noticed this debt had been placed on my credit report. I am disputing the above referenced debt. Please verify this debt as required by the Fair Debt Collection Practices (FDCPA) (section 1692g) and New York City Administrative Code (section 20-493.2). New York City regulations require all debt collectors to send specific written documentation verifying the debt. Under section 2-190 of the Rules of the City of New York, verification requires all of the following:

- Proof of my agreement to pay the original creditor

- A copy of the final account statement issued by the original creditor;

- A breakdown of the total amount due, showing principal, interest, and other charges; and

- For all other charges, the date of and the basis for each charge.

I dispute this charge because I do not recognize this debt and I do not owe any money to this creditor. I monitor my report monthly and I have become a responsible consumer and this is an unfamiliar debt to me. If it were indeed valid it would have been paid. Moreover, this debt appears to be past the Statute of Limitations.

Because I am disputing this debt, you should not report it to the credit reporting agencies. If you have already reported it, please notify the credit reporting agencies that the debt is disputed and/or delete the trade line from my credit report. Reporting information that you know to be inaccurate, or failing to report information correctly, violates the FDPCA and their Fair Credit Reporting Act.

Aside from verifying the debt, do not contact me about this debt. The FDCPA and Rules of the City of New York (section 5-77) require that you honor this request.

Sincerely,

Tonya Rapley

Cc: Enhanced Recovery Systems

Federal Trade Commission Consumer Response Center

New York City Department of Community Affairs

I also sent a credit report dispute letter to the bureaus that were reporting this debt. You can find an example here.

Within two weeks I started to see things happen.

I received notice of receipt from the NY Department of Consumer Affairs and I received a corrected report from one of the bureaus. I didn’t receive a letter from ERS but I checked my report this month and the debt has been removed and my score is back looking like its usual self.

I beat them at their own game.

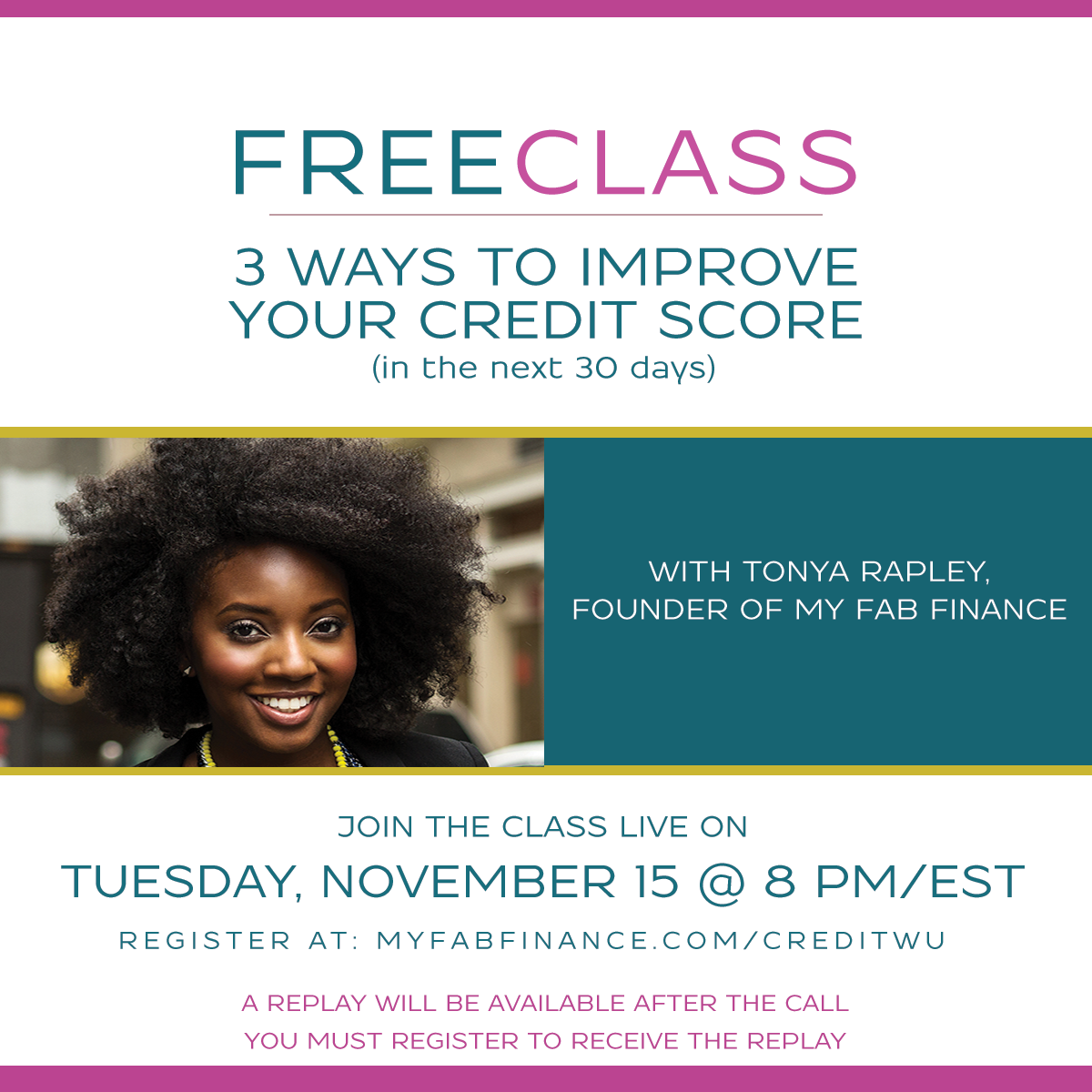

As consumers we have powerful protections available to us, but collection companies profit off of our lack of knowledge and you won’t get answers to the questions that you don’t ask. The correct and dispute process is the “C” component of my S.C.R.U.B Method: A 5 step process for credit self-improvement. I will provide step by step instructions for the entire process in my upcoming book.

If you are interested in receiving the book make sure you sign up for our weekly mailing list so you will be one of the first to know when it’s released.

You said: