The word budget evokes dreadful emotions for many people. It is not surprising to know that only one in three people maintain a household budget. With a multitude of options to monitor your spending and attaining your financial goals, managing your budget has become quite convenient. Let’s look at five of the best apps for a tight budget (or finances):

1. Mint (iTunes and Android)

Mint’s strength lies in its capability to provide a big-picture view of your finances. It helps you keep track of your income, spending trends and lets you stay on top of transactions with its colorful layout. The app will even analyze your spending habits to give you valuable tips to improve your finances. Mint is a free tracking tool, which helps you set monthly goals by categorizing your expenses.

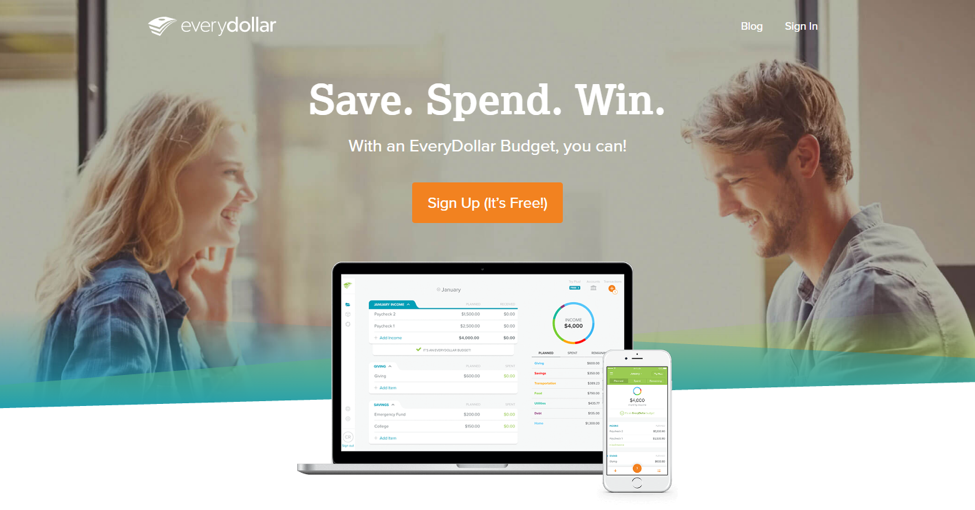

2. Every Dollar (iTunes and Android)

Created by personal finance guru Dave Ramsey, Every Dollar aims to facilitate budgeting and is based on the envelope method with the theory of giving a job to every single buck. The app offers eight main budgeting categories: Transportation, Lifestyle, Food, Giving, Insurance & Tax Insurance, Savings, Debt and Housing. It works by assigning funds to the planned field for every category. You don’t need to follow Ramsey’s teachings to consume Every Dollar. However, you will benefit if you do. Every Dollar is free but you will have to add transactions manually.

3. You Need a Budget (iTunes and Android)

We all want to make a budget since we want to know how much we can spend and save. Quite popular as YNAB, the budgeting tool was once limited to desktops only. Luckily, the functionality has been extended to your tablet and smartphone. Enter your transactions and the app automatically synchronizes to your desktop when you are online. You can also try it before you purchase it. The software is available for a one-month trial and there is a free version of the app, known as YNAB Lite.

4. Debt Manager (iTunes)

One of the smartest ways to get out of debt is to use the “Debt Snowball” method. Enter all the information regarding loans and payment, set priorities and begin playing with the numbers. You can also try different circumstances, for instance, augmenting your payments or a rise in interest rates. Debt Manager also highlights how much interest and time you are saving. It also motivates you by graphing your progress.

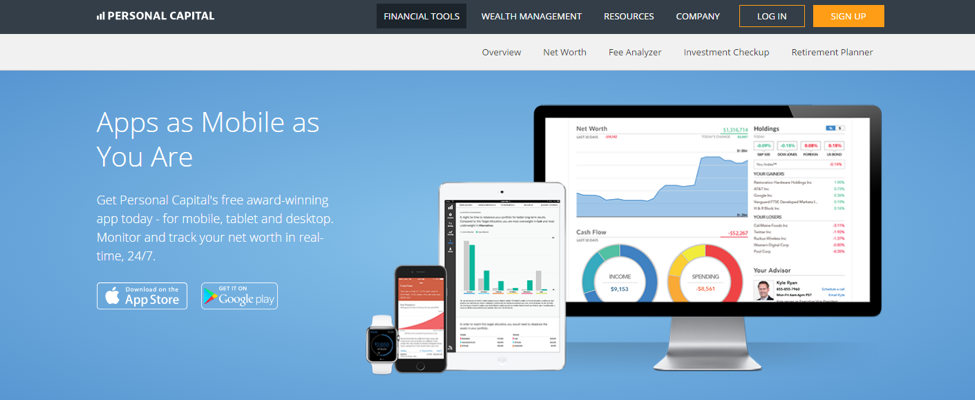

5. Personal Capital (iTunes and Android)

This app is a brainchild of former PayPal and Intuit CEO Bill Harris. The budgeting app helps you track your monthly expenses, debt and savings. However, its actual focus is investments. Personal Capital assesses your brokerage accounts and prompts you when you should sell some stock or diversify your investments. The app’s Fee Analyzer and retirement planner helps you monitor the progress of your savings goals and keeps you on track. For all people who have mastered their budget and savings and can play with some dollars, they can consider using this powerful money management app.

About the Author:

Elena Tahora is the Content Marketing Writer at Malta Real Estate, responsible for managing the content calendar and contributing to the creation of Sotheby’s Realty’s free educational materials, such as blog articles, eBooks and webinars.

You said: