Today’s guest post is from my friend Stacey Flowers. You might remember Stacey from her body transformation post, it was so popular even my graphic designer asked me about it for his wife! I was so impressed by Stacey’s commitment to pay down 100k of her student loan debt that I wanted to share her story. Enjoy!

On February 23, 2014, I reviewed my five-year financial plan.

On February 23, 2014, I reviewed my five-year financial plan.

In it, I detail how I intend to be a millionaire by the time I’m 30, how I plan to have my son and eldest niece’s college funds fully vested by their 16th birthdays, and lastly how I plan to have my student loans paid in full by 2016.

When I really looked at this plan I realized that somehow I got my numbers confused because I expect to be a millionaire before my student loans are paid-in-full. WHAT?!?!?!?! This obviously makes no sense.

I suspect when I drafted my financial plan I was “dreaming”. But as my vision is drawing closer and clearer by the second, I am aware that my dreams are fast becoming my reality.

In an act of FAITH, I declare and decree that I will pay my student loan debt in FULL within the next 12 months.

How much will I pay by February 23, 2015? $159,664.00.

YES, your reading that number correctly. And I’m sooooo super serious.

So how will I do it?

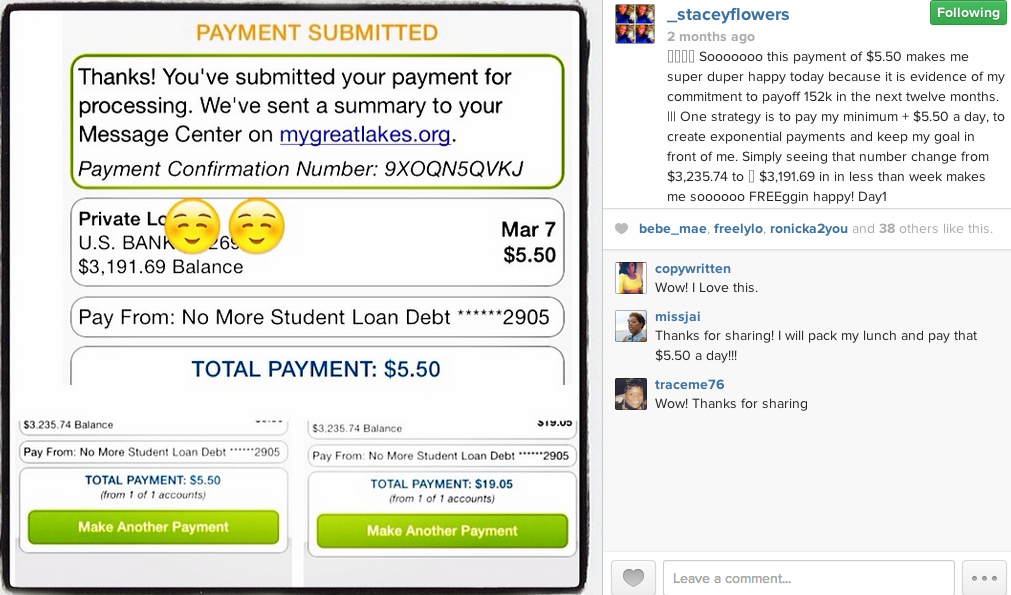

Everyday I will make a PAYMENT of $5.50 or more. If I only pay $5.50 a day for one year I will have paid $2000.00 toward my student loan debt in just one year. Obviously I need to pay way more than $2000 a year to get everything paid off; however this payment is designed to keep my goal right in front of me and make sure that I am making progress daily.

I created a Mr. Miyagi payment to support consistent payments and focus my attention. With everything that happened this month in terms of potential expenses this one action was truly my savings grace.

This type of thinking would be the equivalent of me trying to bench press 250 lbs, even though I’ve never lifted the bar. These small daily payments are like going to the gym everyday and getting comfortable with the bar, knowing that I’ll slowly add weights so I can build the strength to reach my goal of benching $160K. You may not believe this but these teeny tiny payments makes me so FREEggin happy. Sometimes you have to play mind games with yourself.

I will aggressively increase this daily amount eventually reaching the amount that will enable me to pay off the entire balance.

As of April one month into my goal I have paid $391.05.

My Starting Debt: $159,664.00

Ending Debt: $159,252.95

So far I am super proud of myself. I increased my debt payments by nearly 400%. No I’m not deceiving myself with this statistic I am celebrating my big, SCARY, AUDACIOUS step on to this course.

The sound bite for these musings could very easily be: a mompreneur of two pays off $160k of student loan debt in less than a year by paying $5.50 a day and $391.05 in her first month, read on to learn how she did it!

Wouldn’t you be more likely to read that story than this story: a mompreneur of two pays off $160k of student loan debt by winning the lottery and paying debt instead if spending her winning, read on to learn how she did it! The former is a TON more realistic, doable, and hopeful.

My point is: this is a very real thing that I’m doing and as one commenter said it’s nice that I’m not paying off my debt with one magical lump sum of money. 1. I don’t have a magical lump sum of money sitting around 2. When I had a fairly nice lump sum I didn’t pay debt because I wasn’t taught to pay debt as a priority systematically over time.

Lastly, I’ve come to realize in the 13 posts that I wrote this month the reason why I was inspired to go on this quest publicly was to inspire HOPE.

I want my generation and peers to be hopeful about the future we are creating. I want as to know that hope is powerful enough to dig ourselves out of a $160k holes we’ve created.

I dare you to follow me, I double dare you to hold me accountable, and I triple dog dare you to join me!

#nomorestudentloandebt

Stacey has mastered the art of achieving goals and she is an expert when it comes to living happy. Click here for access to her Happiness Manifesto: A brief guide on becoming the happiest person you know.

You said: