You’ve pressed the reset button on the year and by now you’ve hopefully determined what your financial goals will be for this year..

If improving your credit score is one of those goals, knowing and understanding your credit report details are crucial to improving your credit score. My reason for starting My Fab Finance and embarking on my financial journey was to improve my credit. Think of the credit report as your roadmap for making that happen.

While I won’t discuss the various sections of a credit report in this post, I will provide a tutorial so that you can access yours for free. There are several companies, including FreeCreditReport.com, who swindle consumers into paying for their report when your report is available absolutely FREE.

If you would like help understanding your credit report refer to the Credit Report Post. It’s long, but hella informative.

The following instructions are for accessing your Equifax report.

Lets get started!

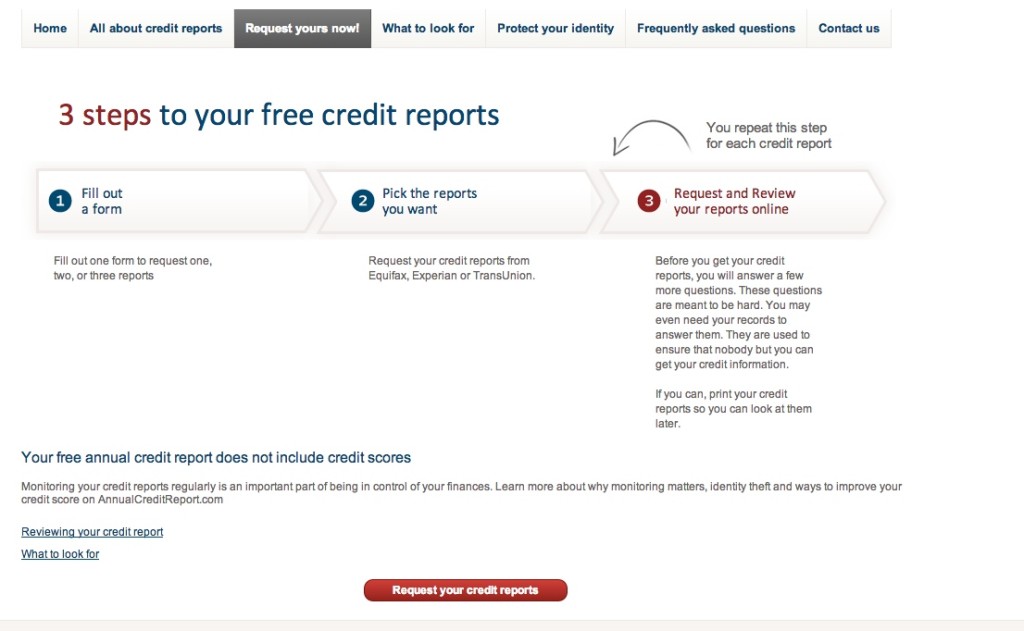

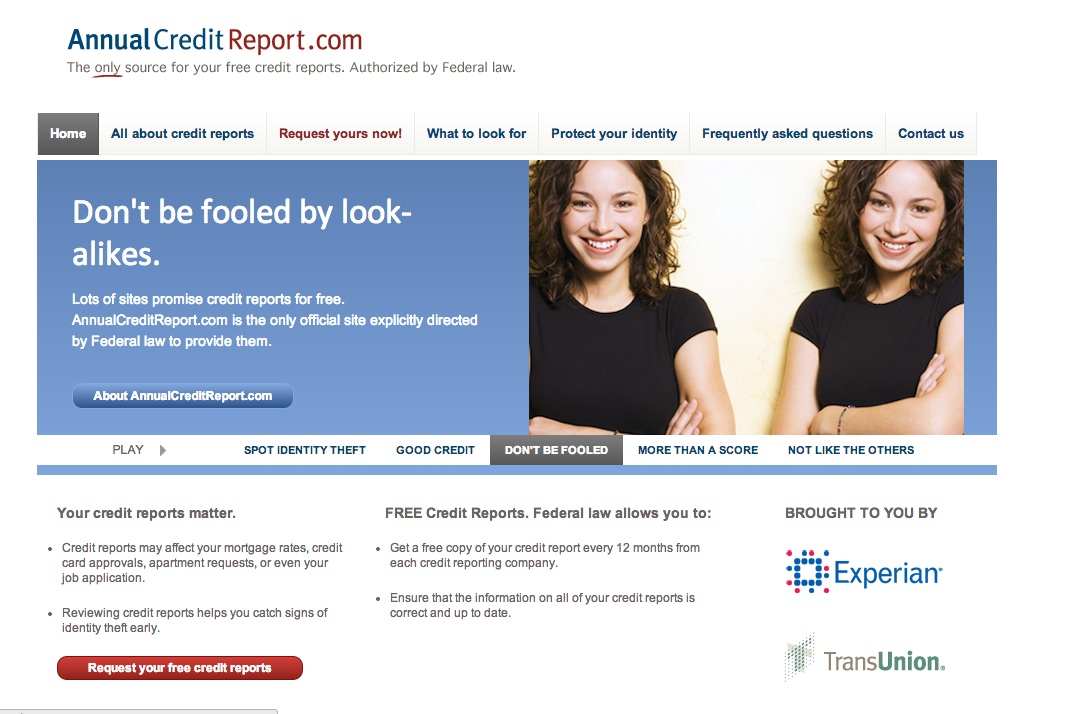

1.Make sure you go to annualcreditreport.com. If the page doesn’t look like this (with the exception of the slider image) you are probably in the wrong place.

Click on the red box at the bottom that says “Request your free credit reports”

2. On this next page all you have to do is click “Request your free credit reports” again

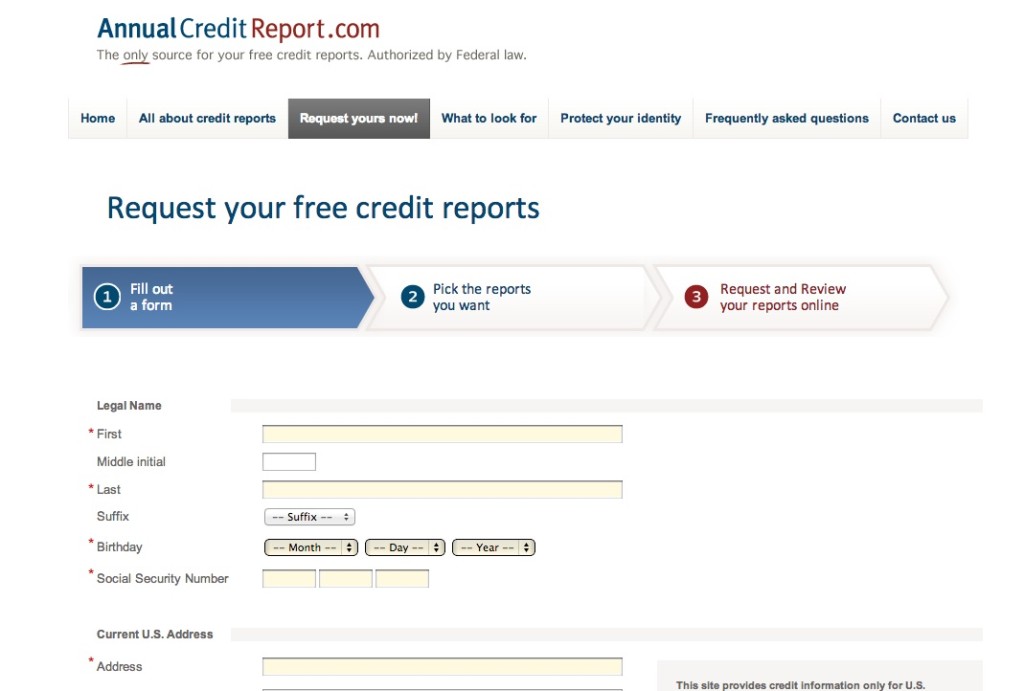

3. This page is officially step one. Here, you will enter your personal information. Be sure to double check for accuracy. If you have not lived at your current location for more than a year, be prepared to enter your previous addresses as well. Once you’ve entered your information, proceed to the next page.

3. This page is officially step one. Here, you will enter your personal information. Be sure to double check for accuracy. If you have not lived at your current location for more than a year, be prepared to enter your previous addresses as well. Once you’ve entered your information, proceed to the next page.

4. On this page you can decide which credit bureau you’d like to retrieve your report from. As you know, there are three credit bureaus: Experian, Transunion, and Equifax. I recommend pulling one from each site every few months. For example pull Equifax in January, Experian in June, and Transunion in November. While information can differ from one report to the other, for the most part they are the same. Pulling every few months will allow you to monitor new items, disputes, possible mistakes, and items that might have fallen off.

Make sure you keep a record of the date in which you accessed each credit report bureau’s website.

5. The next page will prompt you to verify the last 4 digits of your Social Security number. If all info is correct, you can proceed to the next page.

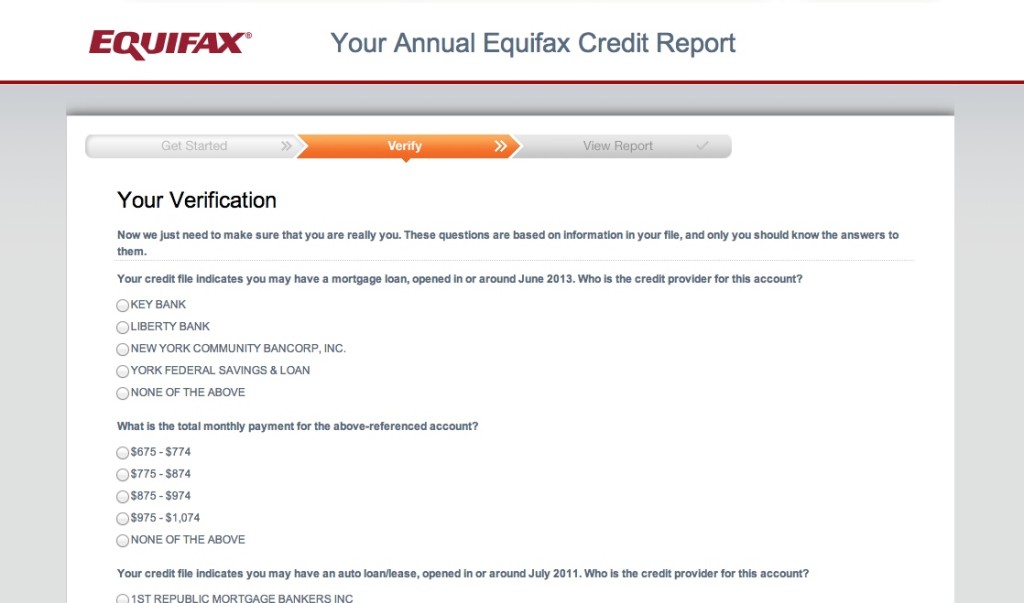

6. I call this the trick questions page. On this page you will be asked questions to verify your identity. Please be aware they do throw false information into the mix. Some or all answers could be “None Of The Above”. It is important to answer correctly. If you answer any of these questions incorrectly, you will not gain access to your online credit report. You will also have to go through the time consuming process of requesting it by mail.

After you have provided your answers proceed to the next page.

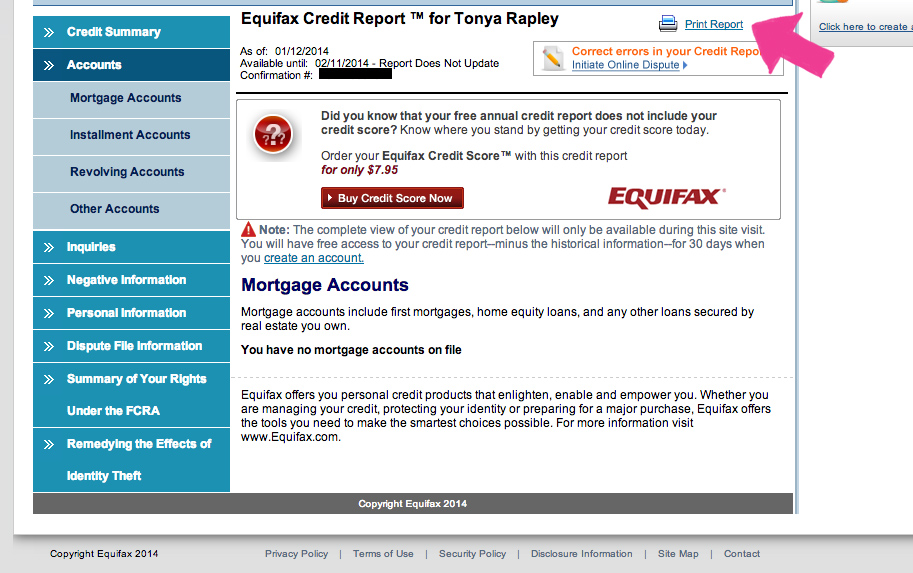

7. This is the page with your credit file number. Be sure to notate your transaction code – which will be provided in the first sentence. From this page, you will click on the box that says view and print your report (the box next to the pink arrow).

8. You will finally receive your credit report! Before you do anything, print and/or save your report as a PDF. (the box next to the pink arrow)

Again as stated, if you need additional help navigating your report, please refer to our Understanding your Credit Report Post.

You said: